Easy to use and with a terrific technical support staff.

Seattle, WA

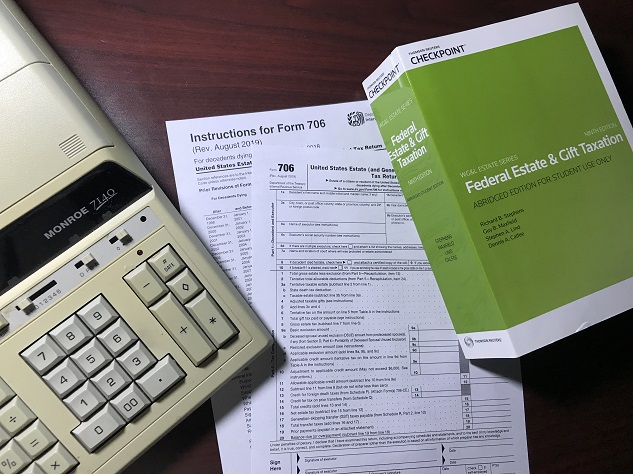

GEM706

GEM706 is a comprehensive program that prepares:

- Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return;

- Form 706-NA (United States Estate (and Generation-Skipping Transfer) Tax Return for nonresidents not citizens of the United States); and

- Form 8971 (Information Regarding Beneficiaries Acquiring Property From a Decedent).

If you are using GEMAcct to prepare the estate's accounting, you can transfer all assets, liabilities, and other deductions directly to the appropriate schedule on Form 706. You can then make changes within GEM706 to the information transferred from GEMAcct or add additional items. GEM706 can also be used as a stand-alone program. GEM706 also has several state modules to prepare state death tax returns.

GEM706 handles all aspects of the return preparation process, including the following:

- GEMAcct Gateway permits you to transfer information from the estate's accounting to the appropriate schedule. You can also transfer data from the estate tax return to the accounting.

- You can download holdings from thousands of financial institutions to GEMAcct and GEM706.

- You can print each schedule and document in PDF format, making it easy to e-mail drafts and the final return to beneficiaries, executors, and other interested parties.

- You can easily perform interrelated calculations where federal or state death taxes are payable out of assets that qualify for the marital or charitable deduction.

- If the decedent's will incorporates a marital deduction formula clause, you can identify an item on Schedule M as the optimum marital bequest, and GEM706 automatically computes the smallest marital deduction amount required to eliminate the federal estate tax.

- Each item may have a header and unnumbered appendages, and you can reorder items easily by using GEM706's drag/drop feature.

- GEM706 interfaces with EVP Systems, Inc. to value securities as of the decedent's death and the alternate valuation date in accordance with Treasury regulations.

- GEM706 includes a comprehensive manual in a PDF format that you can search, view, or print.

If you would like to view a demonstration on line, click here.

To download a fully functional demonstration version of GEMS, click here.

If you would like more information about GEM706, e-mail or call our sales department at 888-GEMS706 (436-7706).