I think this is the best most absolute wonderful program out there. Thank you so much for making it simple again.

Los Angeles, CA

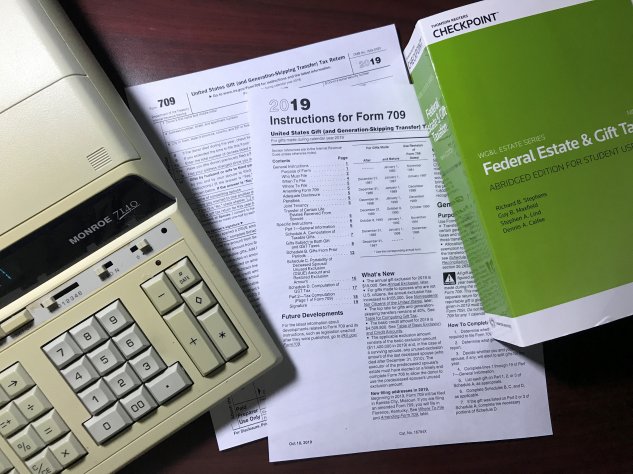

GEM709

GEM709 prepares the Federal Gift Tax Return. The Internal Revenue Service issues Form 709 on an annual basis, usually in December.

GEM709 incorporates an innovative method to enter split gifts and gifts of community property. When you initialize a marital file, you enter all gifts made by each spouse in the same file. You can toggle between their returns by clicking on their respective tab at the top of the screen. Their individual schedule tree summarizes all of the gifts they have made, including split gifts and gifts of community property. A change to one spouse's gifts is instantly reflected on the other spouse's return.

GEM709 includes the following additional features:

- GEM709 permits you to print the return and all attachments in PDF format, making it easy to e-mail drafts and the final return to the donors and other interested parties.

- You can automatically allocate to direct and indirect skips sufficient GST exemption to create a zero inclusion ratio.

- If you are making a formula allocation of the donor's GST exemption, GEM709 adds appropriate language to the return which you can customize.

- You can easily perform net gift calculations where the donee agrees to pay the resulting gift tax liability.

- GEM709 provides multiple printing options which permit you to customize Schedule A, including separate choices for the printing of Crummey transfers.

- GEM709 includes a comprehensive manual in a PDF format that you can search, view, or print.

To purchase GEMS, click here.

If you would like to view a demonstration on line, click here.

To download a fully functional demonstration version of GEMS, click here.

If you would like more information about GEM709, e-mail or call our sales department at 888-GEMS706 (436-7706).